February 19, 2025

.jpg)

India’s banking sector has exhibited remarkable resilience and growth in Q4 FY-2024, driven by strong economic fundamentals, digital advancements, and policy support. The sector continues to benefit from robust credit growth, driven by USD 132.85 billion (₹11.11 trillion) infrastructure investment in 2025. This investment is expected to generate significant credit demand across transportation, energy, and urban development.

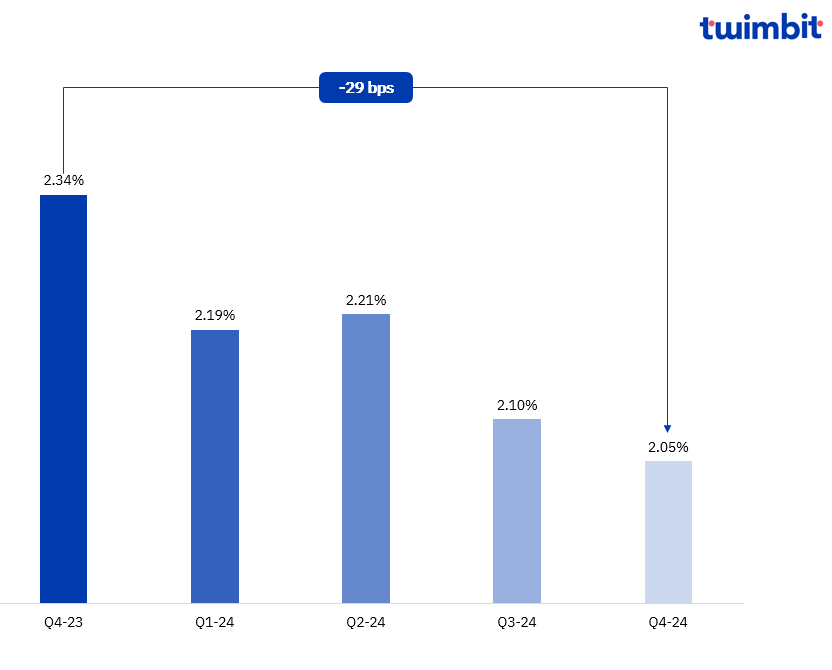

Additionally, asset quality has improved, with the average Non-Performing Loans (NPL) ratio declining by 29 bps, from 2.34% in Q4 FY-2023 to 2.05% in Q4 FY-2024. This reflects better risk management across the sector.

This analysis delves into key performance metrics of the top Indian banks, examining revenue growth, profitability, fee-based income, non-performing loans, and cost efficiency. Additionally, we explore growth opportunities for Indian banks in light of economic developments, including insights from the Union Budget 2025.

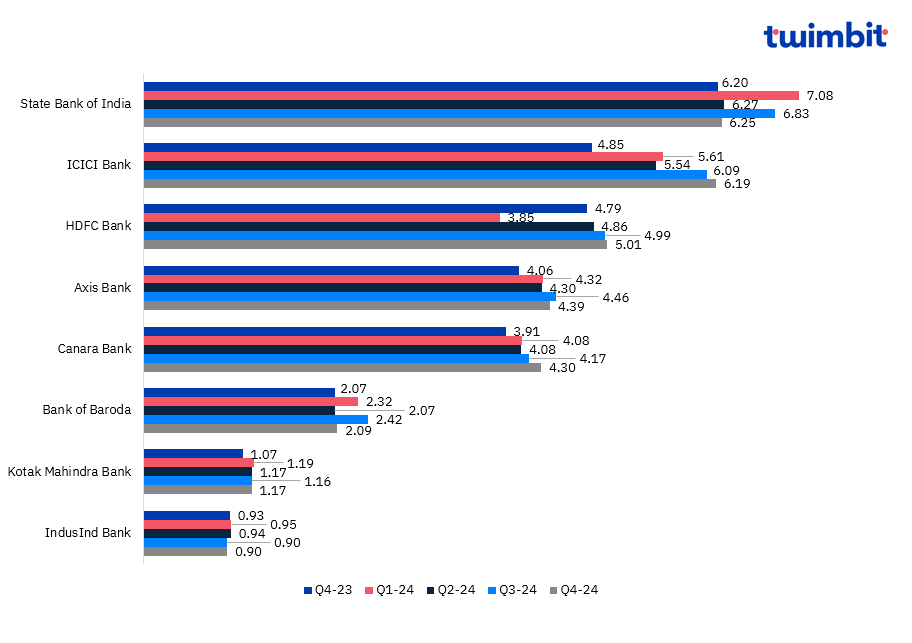

India's banking sector showcased impressive growth in Q4 FY-2024, with leading banks collectively achieving an 8.67% YoY increase in net revenues, climbing from USD 27.8 billion in Q4 FY-2023 to USD 30.2 billion in Q4 FY-2024.

Exhibit 1: Net revenue of India’s top banks

ICICI Bank

ICICI Bank recorded a 27.61% YoY growth in net revenue, reaching USD 6.2 billion in Q4 FY-2024 from USD 4.8 billion in the previous year. Key drivers included a 7.98% rise in core operating income, increasing from USD 2.9 billion to USD 3.2 billion, and a 7.26% increase in net interest income, rising from USD 2.2 billion in Q4 FY-2023 to USD 2.4 billion in Q4 FY-2024.

IndusInd Bank

IndusInd Bank reported a 3.05% YoY decline in net revenue, falling from USD 930.7 million in Q4 FY-2023 to USD 902.3 million in Q4 FY-2024. This decline was attributed to a 3% decrease in net interest income from USD 640.8 million to USD 622.1 million.

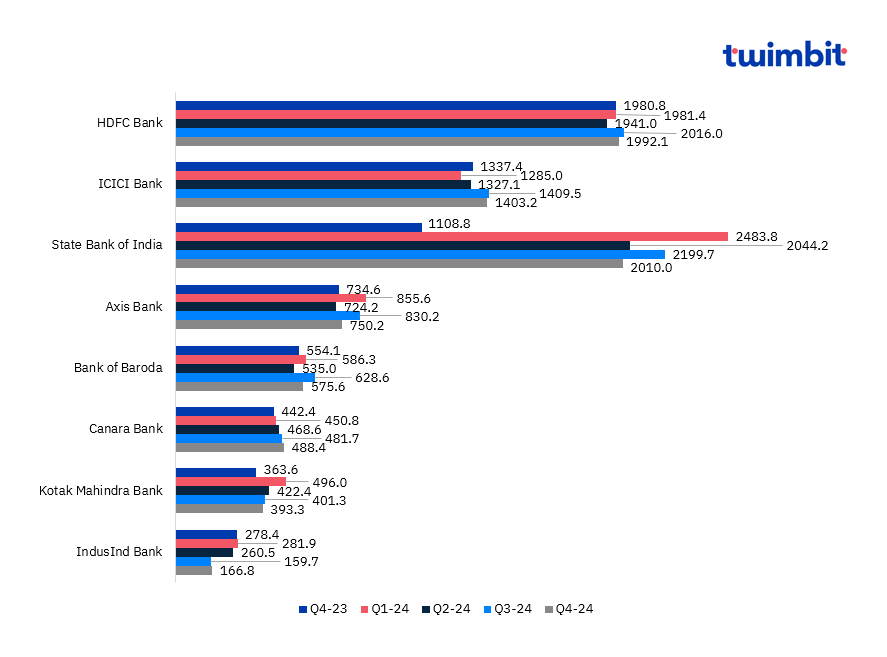

India's leading banks collectively recorded a 14.4% YoY increase in net profits, rising from USD 6.8 billion in Q4 FY-2023 to USD 7.7 billion in Q4 FY-2024.

Exhibit 2: Net profit of top India’s banks

State Bank of India (SBI)

SBI demonstrated strong profitability growth, with net profit rising by 81.27% YoY to USD 2 billion, up from USD 1.1 billion in the same quarter of the previous year. Key growth drivers included a 13.9% rise in operating profit, increasing from USD 2.4 billion to USD 2.8 billion, a 2.37% increase in net interest income, rising from USD 4.8 billion in Q4 FY-2023 to USD 4.9 billion in Q4 FY-2024, and an 8.02% reduction in operating expenses, which declined from USD 3.7 billion to USD 3.4 billion.

IndusInd Bank

IndusInd Bank reported a 40.08% YoY decline in net profit, falling from USD 278.4 million in Q4 FY-2023 to USD 166.8 million in Q4 FY-2024. This decline was attributed to a 7.3% increase in operating expenses, rising from USD 441.6 million to USD 473.8 million, and a 3.34% reduction in other income, decreasing from USD 290 million to USD 280 million.

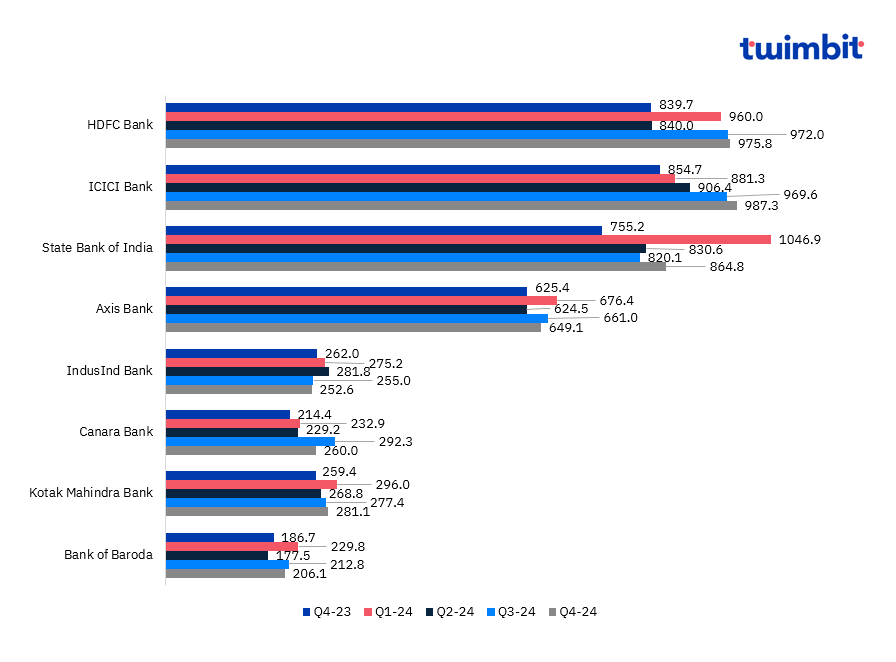

Fee income across India’s leading banks saw an increase of 12% YoY, rising from USD 4 billion in Q4 FY-2023 to USD 4.4 billion in Q4 FY-2024.

Exhibit 3: Fee incomes of the top banks in India

Canara Bank

Canara Bank posted a 21.27% YoY growth in fee income, reaching USD 260 million, up from USD 214.4 million in the same quarter of the previous year. Growth was driven by a 28.13% increase in commission, exchange, and brokerage, rising from USD 46 million to USD 59 million, and a 12.76% rise in service charges, increasing from USD 99 million in Q4 FY-2023 to USD 111.7 million in Q4 FY-2024.

IndusInd Bank

IndusInd Bank's fee income fell by 3.56%, dropping from USD 262 million in Q4 FY-2023 to USD 253 million in Q4 FY-2024. The decline was primarily due to a 6.52% reduction in loan processing fees, which decreased from USD 75.7 million to USD 70.8 million.

The average NPL ratio across India’s leading banks declined by 29 bps from 2.34% in Q4 FY-2023 to 2.05% in Q4 FY-2024.

Exhibit 4: NPL of the top banks in India

IndusInd Bank

IndusInd Bank recorded a 33 bps increase in its NPL ratio, rising from 1.92% in Q4 FY-2023 to 2.25% in Q4 FY-2024. This increase was driven by a 0.8% rise in corporate banking outstanding, increasing from USD 20.2 billion to USD 20.4 billion, and a rise in borrowings by 21.71% rising from USD 5 billion to USD 6 billion.

Bank of Baroda

Bank of Baroda reduced its NPL ratio by 65 bps, declining from 3.08% in Q4 FY-2023 to 2.43% in Q4 FY-2024. This decline was supported by a 20% increase in reduction- upgradation, where loans previously classified as non-performing assets (NPAs) were moved back to performing asset status, rising from USD 87.2 million to USD 104.3 million.

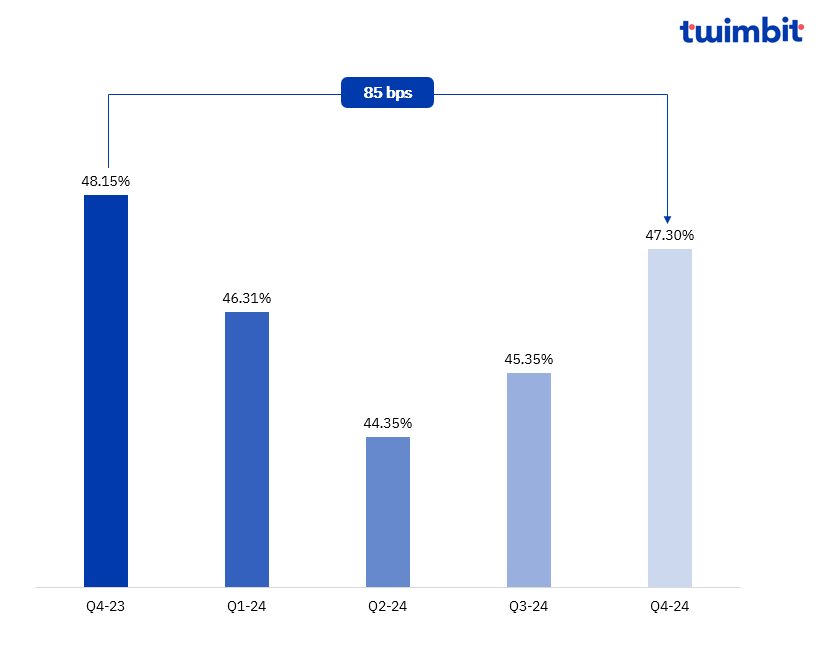

The average cost-efficiency ratio across India’s leading banks decreased by 85 bps, from 48.15% in Q4 FY-2023 to 47.3% in Q4 FY-2024.

Exhibit 4: CE of the top banks in India

IndusInd Bank

IndusInd Bank’s cost-to-income ratio increased 10.71%, reaching 52.22%, up from 47.44% in the same quarter of the previous year. The 9.6% decline in operating income/revenue, from 52.55% to 47.49%, outpaced the 7.29% increase in operating expenses, which rose from USD 441.6 million to USD 473.8 million. This imbalance reflects margin compression and weaker operational efficiency, potentially impacting overall profitability.

State Bank of India

SBI improved its cost efficiency, reducing its ratio by 8.63% from 60.34% in Q4 FY-2023 to 55.13% in Q4 FY-2024. This improvement was mainly due to a 12.37% decline in operating expenses, decreasing from USD 493 million to USD 432 million.

The adoption of AI and machine learning in banking enables enhanced personalized financial services, including AI-driven financial planning, customized loan offerings, fraud detection, and automated investment management. These technologies contribute to operational efficiency and improved risk management.

Government initiatives supporting digital payments are fostering increased transaction volumes and fee-based revenue opportunities. Additionally, collaborations with fintech firms specializing in alternative lending, AI-driven credit assessment, and embedded finance are facilitating product diversification and enhancing customer acquisition and retention strategies.

The USD 132.85 billion (₹11.11 trillion) infrastructure investment in 2025 is expected to generate significant credit demand, particularly in transportation, energy, and urban development.

Banks are positioned to leverage this demand through syndicated lending, infrastructure bonds, and advisory services for public-private partnerships (PPPs). Institutions with strong corporate banking capabilities may benefit from expanded loan portfolios, improved margins, and enhanced fee-based revenue streams. Additionally, structured financing solutions can support risk optimization and income diversification.

Income tax reductions in 2025 may contribute to increased disposable income, potentially driving demand for investment products and financial planning services.

Banks can address this shift by expanding wealth management offerings, including personalized advisory, mutual funds, insurance, and retirement planning solutions. These initiatives could enhance customer engagement and support revenue growth in an evolving financial landscape.